Category Archives: offshore oil

Houston Chronicle: Grippando: Russian drilling in Cuban waters presents problems for U.S.

http://www.chron.com/opinion/outlook/article/Grippando-Russian-drilling-in-Cuban-waters-5359932.php

By James Grippando | March 29, 2014 | Updated: March 29, 2014 2:41pm

Photo By Javier Galeano/STF

An exploratory drilling rig sits in the waters off Cuba’s northern coast as fishermen work in Havana Bay, Cuba. An exploratory drilling rig sits in the waters off Cuba’s northern coast as fishermen work in Havana Bay, Cuba.

Recent events in Washington have sparked debate about the future environmental safety of thousands of miles of coastline, from Texas to the Florida Keys. Earlier this month, the U.S. Environmental Protection Agency lifted its ban against BP from offshore drilling in the Gulf of Mexico. Then, in the wake of Russia’s seizure of a natural gas plant in Crimea, the West deliberated sanctions against Russia that could accelerate Russia’s ongoing exploration for natural gas in Cuban waters south of Key West.

Critics argue that BP’s agreement with the EPA comes too soon after the 2010 Deepwater Horizon disaster that killed 11 workers and caused catastrophic environmental damage. Concerns over the agreement may or may not be valid, but a compelling case can be made that the Russian exploration presents the more vexing problem. While BP will resume drilling under strict supervision and detailed conditions, Russian oil companies are drilling offshore in Cuban waters with no U.S. oversight.

Russia and the giant oil companies it controls are key players in offshore exploratory drilling in Cuban waters. An estimated 5.5 billion barrels of oil and another 9.8 trillion cubic feet of natural gas lies beneath a mile or more of ocean in the Cuban basin, midway between Havana and Florida. Last year, the Spanish oil company Repsol drilled just 56 miles from Key West. The project was unsuccessful, but exploration continues.

In January, Bob Graham, a former Florida senator and governor who co-chaired a presidential commission on the Deepwater Horizon spill, reported that Cuba and its state-owned oil company are “aggressively” pursuing plans to drill offshore. Cuba’s primary target is near the maritime border in waters that could be 10,000 to 12,000 feet deep. Experts agree that with the Gulf Stream moving at three to four knots, a Cuban oil spill would affect Florida in just six to 10 days.

What could the U.S. do to avert disaster in the event of a major spill in Cuban waters, particularly one that involves a Russian-controlled drilling operation? BP paid roughly $40 billion in fines and damages for the devastation it caused, and pleaded guilty to criminal charges. Who would hold the Russians and other companies drilling in Cuban waters accountable?

The lack of any diplomatic relations between the U.S. and Cuba, let alone a maritime treaty, means that the U.S. cannot be assured of the safety standards in Cuban drilling operations.

In June 2013, the Moscow Times reported that the Russians’ exploratory drilling was cut short due to safety concerns over the “blowout preventer,” the same crucial piece of equipment that was at the heart of the BP spill. The Russian’s self-restraint, however, had nothing to do with U.S. oversight, and there is no guarantee that the Russians will be as cautious going forward, particularly as relations with the U.S. worsen over the crisis in the Ukraine.

The longstanding U.S. trade embargo against Cuba presents huge obstacles. Under the embargo, the massive semisubmersible rigs used in offshore drilling in Cuban waters can contain no more than 10 percent U.S. parts. The embargo makes it difficult if not impossible to obtain replacement parts from U.S. companies, which only heightens the risk of a mishap. The U.S. response to a spill would be equally hamstrung. According to the Council of Foreign Relations, which sent Graham on his recent trip to Cuba, the U.S. Coast Guard would be barred from deploying highly experienced manpower, specially designed booms, skimming equipment and vessels, and dispersants. U.S. offshore gas and oil companies would also be barred from using well-capping stacks, remotely operated submersibles and other vital technologies.

A catastrophe in Cuban waters would leave little time to work through these issues. According to the U.S. Coast Guard, the most, and possibly only, effective response to a spill in the fast-moving Cuban waters would be surface and subsurface dispersants. If dispersants are not applied close to the source within four days after a spill, uncontained oil cannot be dispersed, burned or skimmed, which would render standard response technologies like containment booms ineffective.

The former president of Amoco Oil Latin America, Jose Piñon, now a research fellow at the University of Texas at Austin and a leading authority on Cuban oil exploration, estimates that Cuba has approximately 5 percent of the resources it needs to respond to a spill on the order of Deepwater Horizon. Indeed, the Washington Post reported that the current disaster response plan is to retrofit and deploy aging crop dusters from Cuban farms to dump dispersants. Current U.S. laws and the current status of U.S./Cuba relations raise serious questions as to whether the U.S. could supply the needed resources in time to avert disaster.

It remains to be seen if BP will be a more responsible corporate citizen as it resumes drilling in the Gulf. That BP will improve its safety measures, however, seems much more likely than Russia, and the Russian oil companies that are behind the Cuban exploration, stepping up to save Florida from disaster.

Grippando, counsel to the law firm of Boies Schiller & Flexner, is a New York Times best-selling author. His 21st novel, “Black Horizon,” was published in March by HarperCollins.

Special thanks to Richard Charter

WECT: Energy Council rep. calls on N.C. to split future offshore oil money with coastal counties

http://www.wect.com/story/25019542/energy-council-rep-calls-on-nc-to-split-future-offshore-oil-money-with-coastal-counties

Posted: Mar 19, 2014 12:34 PM PDT

Wednesday, March 19, 2014 3:34 PM EST

Updated: Mar 19, 2014 12:44 PM PDTPM EST

By: Justin Smith – email

At the Energy Policy Council meeting Wednesday in Raleigh, Frank Gorham introduced a proposal that state lawmakers commit to share federal offshore oil revenues with the 20 coastal counties

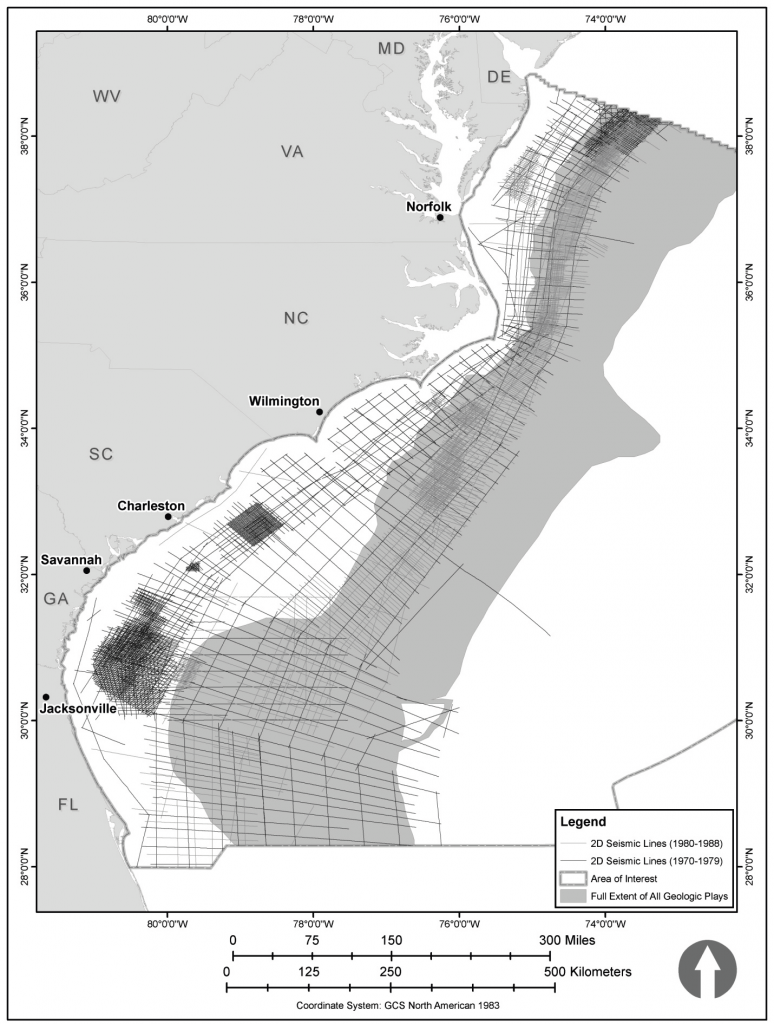

RALEIGH, NC (WECT) – A New Hanover County member of the N.C. Energy Policy Council says he doesn’t think offshore drilling will ever happen in the Atlantic Ocean off the North Carolina coast unless coastal counties share in the profits.

At the Energy Policy Council meeting Wednesday in Raleigh, Frank Gorham introduced a proposal that state lawmakers commit to share federal offshore oil revenues with the 20 coastal counties. Those communities could use the money for beach renourishment, wetlands restoration, or other needs, he explained.

“I’ve traveled the whole coast, and the number one thing I’m hearing is the coastal communities are seeing only a negative to offshore drilling,” Gorham said, who is chair of the N.C. Coastal Resources Commission.

The Energy Council is a 13 member board of appointees that submits energy policy recommendations to the governor and General Assembly.

Gorham, who explained Texas and Louisiana set aside a large portion of their federal oil royalties for coastal communities, wants the N.C. legislature to agree to give half of any offshore revenue to the coastal counties, but drilling off North Carolina’s coast is not imminent. Gorham estimates seismic testing could be allowed within the next year and a half, with the federal leasing for drilling following several years later.

Lt. Gov. Dan Forest, who serves as chair of the N.C. Energy Council, explained conversations have already started in the state regarding revenue sharing for onshore gas. He believes those talks will lead into discussions about offshore revenue.

Forest thinks the Council will be receptive to Gorham’s proposal but said, “the reality of the situation is offshore drilling is really in the hands of the federal government right now. They hold all the cards to that discussion.”

Gorham’s proposal was sent to the Energy Council’s exploration committee for consideration.

Obama Administration to Offer 40 Million Acres in the Gulf of Mexico for Oil and Gas Development–first lease in the Eastern Gulf of Mexico since 2008

“Lease Sale 231 in the Central Planning Area and Lease Sale 225 in the Eastern Planning Area will be held consecutively in New Orleans, Louisiana, on March 19, 2014.”

http://www.doi.gov/news/pressreleases/obama-administration-to-offer-40-million-acres-in-the-gulf-of-mexico-for-oil-and-gas-development.cfm

Department of Interior

Final Notice of Sales for Central and Eastern Planning Areas

02/13/2014

WASHINGTON, DC — As part of the Obama Administration’s all-of-the-above energy strategy to continue to expand safe and responsible domestic energy production, Secretary of the Interior Sally Jewell and Bureau of Ocean Energy Management (BOEM) Director Tommy P. Beaudreau today announced that Interior will offer more than 40 million acres for oil and gas exploration and development in the Gulf of Mexico in March lease sales.

“These lease sales underscore the President’s commitment to create jobs through the safe and responsible exploration and development of the Nation’s domestic energy resources,” said Jewell. “The Five Year Program reflects this Administration’s determination to facilitate the orderly development while protecting the human, marine and coastal environments, and ensuring a fair return to American taxpayers.”

Lease Sale 231 in the Central Planning Area and Lease Sale 225 in the Eastern Planning Area will be held consecutively in New Orleans, Louisiana, on March 19, 2014. The sales will be the fourth and fifth offshore auctions under the Administration’s Outer Continental Shelf Oil and Gas Leasing Program for 2012-2017 (Five Year Program), which makes all areas with the highest-known resource potential available for oil and gas leasing in order to further reduce America’s dependence on foreign oil. The lease sales build on the first three sales in the Five Year Program that offered more than 79 million acres for development and garnered $1.4 billion in high bids.

Domestic oil and gas production has grown each year President Obama has been in office, with domestic oil production currently higher than any time in two decades; natural gas production at its highest level ever; and renewable electricity generation from wind, solar, and geothermal sources having doubled. Combined with recent declines in oil consumption, foreign oil imports now account for less than 40 percent of the oil consumed in America – the lowest level since 1988.

The Gulf of Mexico contributes about 20 percent of U.S. domestic oil and 6 percent of domestic gas production, providing the bulk of the $14.2 billion in mineral revenue disbursed to Federal, state and American Indian accounts from onshore and offshore energy revenue collections in Fiscal Year 2013.

That was a 17 percent increase over FY 2012 disbursements of $12.15 billion.

“As a critical component of the Nation’s energy portfolio, the Gulf holds vital energy resources that can continue to generate jobs and spur economic opportunities for Gulf producing states as well as further reduce the Nation’s dependence on foreign oil,” said BOEM Director Beaudreau.

Sale 231 encompasses about 7,507 unleased blocks, covering 39.6 million acres, located from three to 230 nautical miles offshore Louisiana, Mississippi, and Alabama, in water depths ranging from 9 to more than 11,115 feet (3 to 3,400 meters). BOEM estimates the proposed sale could result in the production of approximately 1 billion barrels of oil and 4 trillion cubic feet of natural gas.

Sale 225 is the first of only two lease sales proposed for the Eastern Planning Area under the Five Year Program, and is the first sale offering acreage in that area since Sale 224 in March of 2008. The sale encompasses 134 whole or partial unleased blocks covering about 465,200 acres in the Eastern Planning Area. The blocks are located at least 125 statute miles offshore in water depths ranging from 2,657 feet to 10,213 feet (810 to 3,113 meters).

The area is south of eastern Alabama and western Florida; the nearest point of land is 125 miles northwest in Louisiana. BOEM estimates the sale could result in the production of 71 million barrels of oil and 162 billion cubic feet of natural gas.

The decision to hold these sales follows extensive environmental analysis, public comment and consideration of the best scientific information available. The terms of the sales include stipulations to protect biologically sensitive resources, mitigate potential adverse effects on protected species and avoid potential conflicts associated with oil and gas development in the region.

In addition to opening bids for these two sales, BOEM will open any pending bids submitted in Western Planning Area Sale 233 for blocks located or partially located within three statute miles of the maritime and continental shelf boundary with Mexico (the Boundary Area). Any leases awarded as a result of these bids will be subject to the terms of the U.S.-Mexico Transboundary Hydrocarbons Agreement, which was approved by Congress in the Bipartisan Budget Act of 2013 and recently signed by the President.

All terms and conditions for Lease Sales 231 and 225 are detailed in the Final Notices of Sale that can be viewed today in the Federal Register. Terms and conditions for Sale 225 are fully explained in a new streamlined format, available at boem.gov/Sale-225 and for Sale 231 at boem.gov/Sale-231.

CD’s of the sale package as well as hard copies of the maps can be requested from the Gulf of Mexico Region’s Public Information Office at 1201 Elmwood Park Boulevard, New Orleans, LA 70123, or at 800-200-GULF (4853).

Special thanks to Richard Charter

New York Times ENERGY & ENVIRONMENT U.S. Agrees to Allow BP Back Into Gulf Waters to Seek Oil

By CLIFFORD KRAUSSMARCH 13, 2014

HOUSTON – Four years after the Deepwater Horizon rig explosion, BP is being welcomed back to seek new oil leases in the Gulf of Mexico.

An agreement on Thursday with the Environmental Protection Agency lifts a 2012 ban that was imposed after the agency concluded that BP had not fully corrected problems that led to the well blowout in 2010 that killed 11 rig workers, spilled millions of gallons of oil and contaminated hundreds of miles of beaches.

BP had sued to have the suspension lifted, and now the agreement will mean hundreds of millions of dollars of new business for the company. But even more important, oil analysts said, it signifies an important step in the company’s recovery from the accident, which has been costly to its finances and reputation.

“After a lengthy negotiation, BP is pleased to have reached this resolution, which we believe to be fair and reasonable,” said John Mingé, chairman and president of BP America. “Today’s agreement will allow America’s largest energy investor to compete again for federal contracts and leases.”

That prospect elicited sharp criticism from environmental groups. “It’s kind of outrageous to allow BP to expand their drilling presence here in the gulf,” said Raleigh Hoke, a spokesman for the Gulf Restoration Network, based in New Orleans.

Under the agreement, BP will be allowed to bid for new leases as early as next Wednesday, but only as long as the company passes muster on ethics, corporate governance and safety procedures outlined by the agency. There will be risk assessments, a code of conduct for officers, guidance for employees and “zero tolerance” for retaliation against employees or contractors who raise safety concerns.

An independent auditor approved by the E.P.A. will conduct an annual review and report on BP’s compliance with the new standards. The agency said in a statement that it would also have the authority to take corrective action “in the event the agreement is breached.”

“This is a fair agreement that requires BP to improve its practices in order to meet the terms we’ve outlined together,” said Craig E. Hooks, the E.P.A.’s assistant administrator of administration and resources.

Fadel Gheit, an oil company analyst at Oppenheimer & Company, said it was “a moral victory for BP.” He added: “It will be the best news BP has gotten since the accident. BP has to get back into the hunt in order for them to score.”

Critics of the agreement noted that nearly four years after the spill, the cleanup has not been completed. Oil still washes up in places, particularly during storms, as happened in October with Tropical Storm Karen.

“They still haven’t really made it right when it comes to the gulf,” Mr. Hoke said.

Public Citizen, a consumer activist group, also expressed outrage, saying in a statement that the settlement “lets a corporate felon and repeat offender off the hook for its crimes against people and the environment.”

The accident continues to mire the company in lawsuits and court hearings. BP settled criminal charges with the Justice Department two years ago for $4.5 billion in penalties, but the oil company faces billions of dollars more in costs from a federal civil trial in New Orleans to determine how much it will be required to pay in Clean Water Act fines.

The company is also arguing that a separate settlement it made with businesses and individuals who suffered losses because of the accident has been misinterpreted. But a federal appeals court ruled this month that the company would have to abide by its agreement and pay some businesses for economic damages without their having to prove the damages were caused directly by the spill.

BP initially estimated that the costs of the settlement would run to $7.8 billion, but it now says the cost could rise well above that.

BP, which employs 2,300 people in the Gulf of Mexico, continues to explore on leases in the gulf from before the 2010 accident. At the end of 2013, the company had 10 drilling rigs in the deep waters of the gulf, and it reported a significant new discovery 300 miles southwest of New Orleans. BP said last year that it intended to invest at least $4 billion on average in the gulf each year for the next decade.

Oil production in the gulf remains below records set in 2009, and the industry continues to recover from a yearlong drilling moratorium that the federal government set after the spill. But several large oil companies, including Chevron and Royal Dutch Shell, are flocking back to the gulf. There were only about a dozen rigs working in the gulf three months after the disaster, and that increased to more than 60 by the end of last year.

When the E.P.A. issued the original ban, it cited BP for “lack of business integrity” because of its role in the accident and said the suspension would remain until the company could provide sufficient evidence that it met federal business standards.

The ban prohibited BP from selling fuel to the Pentagon and prevented the company from expanding its oil and gas production to new leases in the gulf, a major center of its worldwide operations. The company’s older leases make BP one of the most important oil and gas producers in the United States.

BP’s suit, filed last year in federal court in Texas, said that the ban was unjustified and that the agency had neglected to consider safety improvements the company had made.

David M. Uhlmann, a University of Michigan law professor and former chief of the Justice Department’s environmental crimes section, said it was not unusual for corporate monitors to be appointed any time a corporation was convicted of criminal activity, especially in environmental cases. “What is unusual is BP was suspended from government contracting for such a long time,” he added.

Senator Mary L. Landrieu, the Louisiana Democrat in a tough race for re-election, hailed the settlement, although she added that E.P.A. should never have enacted the ban in the first place.

“The good news is that BP will now be able to participate in next week’s lease sale that will bring much-needed revenue to Louisiana and other oil-producing states along the Gulf Coast, as well as boost business for the region’s small and independent service and supply companies,” she said in a statement.

Campbell Robertson contributed reporting from New Orleans.

A version of this article appears in print on March 14, 2014, on page A1 of the New York edition with the headline: U.S. Agrees to Allow BP Back Into Gulf Waters to Seek Oil . Order Reprints|Today’s Paper|Subscribe

Special thanks to Richard Charter