http://www.natureworldnews.com/articles/4016/20130917/bp-oil-spill-cleanup-workers-risk-developing-blood-liver-disorders.htm

By James A. Foley

Sep 17, 2013 12:54 PM EDT

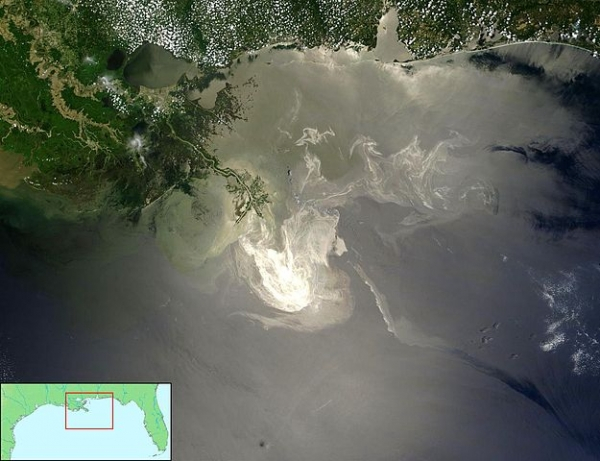

The oil slick as seen from space by NASA’s Terra satellite on 24 May 2010 (Photo : NASA via Wikimedia Commons )

Oil spill cleanup crews who responded to the April 2010 Deepwater Horizon oil spill display “significantly altered” blood profiles, liver enzymes and somatic symptoms compared to an unexposed control group in new research published in the American Journal of Medicine, which suggests that oil spill cleanup workers are at risk of developing liver or blood related disorders.

When the British Petrolium (BP)-owned Deepwater Horizon offshore oil drilling rig exploded, the ensuing oil spill caused some 200 million gallons of crude oil to spill into the Gulf of Mexico. An estimated 170,000 people working on oil cleanup crews used nearly 2 million gallons of dispersants like COREXIT to reign in the mess, according to a news release by Elsevier Health Services.

New research from the University Cancer and Diagnostic Centers in Houston, Texas focuses on the link between oil spill and dispersant exposure to the hematologic and hepatic functions in the subjects. Out of a group of 247 subjects tested between January 2010 and November 2012, 117 of them identified as exposed to the oil spill and dispersants by participating in cleanup efforts over a three month period. The remaining 130 people claimed to be unexposed to the oil spill or clean up effort all lived at least 100 miles away from the Louisiana Gulf Coast.

Comparing blood samples from the exposed and unexposed groups, the researchers found that their white blood cell counts were essentially the same, but the exposed group had a marked decrease in platelet count. Also, blood urea nitrogen and creatinine levels were substantially lower in the exposed group, while hemoglobin and hematocrit levels were increased compared to the unexposed subjects.

Furthermore, considered indicators of hepatic damage, the serum levels of alkaline phosphatase (ALP), aspartate amino transferase (AST), and alanine amino transferase (ALT) in the exposed subjects were also elevated, suggesting the exposed group may be at a higher risk for developing blood-related disorders, the researchers said in a statement.

“Phosphatases, amino transferases, and dehydrogenases play critical roles in biological processes. These enzymes are involved in detoxification, metabolism, and biosynthesis of energetic macromolecules that are important for different essential functions,” said lead investigator G. Kesava Reddy. “Alterations in the levels of these enzymes result in biochemical impairment and lesions in the tissue and cellular function.”

Other health complaints by the exposed subjects included somatic symptoms, with headache reported most frequently, followed by shortness of breath, skin rash, cough, dizzy spells, fatigue, painful joints, night sweats and chest pain, the researchers said.

“The health complaints reported by those involved in oil cleanup operations are consistent with the previously reported studies on major oil spills. However, the prevalence of symptoms appears to be higher in the present study compared with the earlier findings of other investigators,” added Reddy.

The greatest limiting factor in this study was the lack of pre-disaster health data on the subjects involved in the study, but the data collected points to significant health effects on oil spill cleanup workers.

“To our knowledge, no previous study has explored the effects of the oil spill specifically assessing the hematological and hepatic functions in oil spill cleanup workers,” Reddy said. “The results of this study indicate that oil spill exposure appears to play a role in the development of hematologic and hepatic toxicity. However, additional long-term follow-up studies are required to understand the clinical significance of the oil spill exposure.”

Special thanks to Richard Charter